The Business of Pets: Thoughts From Three-Dog Household On Trends, Sectors

Total U.S. pet industry expenditures for 2015, $60.28 billion. For 2016, an estimated $62.75, as reported by American Pet Products Association (APPA) from various market research sources. Sixty-five percent of U.S. households, or about 79.7 million families, own a pet, according to the 2015-2016 National Pet Owners Survey conducted by the American Pet Products Association (APPA). This is up from 56 percent of U.S. households in 1988, the first year the survey was conducted.

Editor's note: A guest column with some insight and a first-hand perspective by Scott Mahoney, a private wealth advisor with the Global Wealth Management Division of Morgan Stanley in Morristown, N.J.

I have three dogs, Muzzler and Sadie, both Labs, and Gracie, a Labradoodle, all of which are part of the family. Muzzler is 14 years old and, like many older dogs, needs special attention to his diet and age-related conditions such as arthritis. We nearly lost Gracie to Immune-Mediated Polymyositis, an autoimmune disorder, but now she takes medication daily and is thriving. We rescued four-year-old Sadie from a negligent owner who confined her to a box. She’s happy now, but still has obvious traces of PTSD when confronted with small spaces.

All three animals have required significant veterinary care and expenses, which we are happy to provide. As a pet owner, I can attest to the trend in spending more and more money – and justifiably so – on the health and well being of our furry family friends.

The pet industry is booming, partly because it’s somewhat more resistant to market fluctuations and economic conditions: we owners will feed and care for our beloved pets regardless of the economy. And that might be just the sort of industry that attracts investors.

In the companion-animal market, U.S. consumers this year are estimated to spend over $62 billion on their pets, and the number is rising, according to the American Pet Products Association (APPA) trade group.

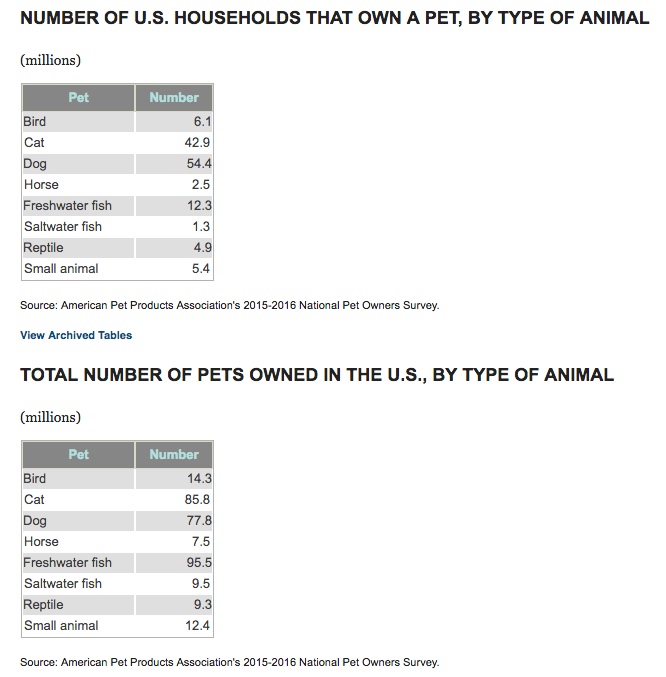

Take a look at the pets humans care for in the USA. listed by species. Image is linked to the complete Insurance Information Institute report.

Consider pet pharmaceuticals. Gone are the days when you could slap a flea collar on Fido, give him a rabies shot, and call it a day. Most dogs and cats receive far more than flea and tick medication and heartworm pills. Their annual rounds of vaccines, titers, and boosters often include Lyme Disease, distemper, parvovirus (a common infectious disorder), leptospirosis (commonly transmitted through puddles containing wild animal urine) and sometimes even hepatitis and measles.

And that’s only for prevention. What about emergency surgery for injuries, swallowing foreign objects, and the like? And diseases: pets are diagnosed with cancer at an alarming rate, with up to 60% of many breeds developing cancer in their lifetime. More and more owners whose pets get cancer and other devastating diseases are apt to treat them, often incurring thousands of dollars in veterinary oncology or medical procedure bills.

The animal pharmaceutical sector is particularly interesting. There is very little consumer access to low-cost generic options for pet medications, which keeps the pricing inflated. The Federal Trade Commission forecasts expenditures of prescription and over-the-counter pet meds to rise to $10.2 billion by 2018.

To help defray medical costs, especially in the case of injury or disease, many pet owners are opting to purchase pet insurance. One well-known pet insurance company now covers 200,000 American pets and has generated returns of over $80 million after only a decade in operation. This is another sector that may interest investors as part of a balanced portfolio.

Investors also may consider pet food conglomerates. There is a huge demand for premium pet food, from organic to grain-free to vegan, and by extension for specialized treats as well. The nation's pet food sales have nearly doubled since 2000, to more than $23 billion last year, according to APPA.

When researching investment possibilities, think beyond doggie day care and grooming salons, beyond even dog psychologists or hotels and spas that offer massages. We humans are not the only beneficiaries of high-tech gadgets; our pets are microchipped, eat from automatic food dispensers, and are contained in their yards by electronic sensors and security systems.

Talking dogs at an event. The vendor offers pet vacations and boarding. Border collies are working dogs, but can adapt to being pets. TW/MDP

Pet ownership is the key to increased growth in the industry; ownership has been on the rise in the United States for the last two decades. According to APPA, some 79.7 million or 65 percent of American households are now pet owners. The demand for pets, especially cats and dogs, is expected to continue to rise through 2018 and probably beyond.

With good reason: our furry friends return our love unconditionally. They are worth every dollar we spend on them and it behooves us to think carefully before we bring an animal into our household, as pet ownership is an expensive proposition. Just ask Muzzler, Sadie and Gracie.

———-

The economic force of the U.S. horse industry stands on its own and contributes significantly to the American economy. The following statistics are from the American Horse Council Foundation’s 2005 National Economic Impact Study (the most recent available). The horse industry contributes approximately $39 billion in direct economic impact to the U.S. economy, and supports 1.4 million jobs on a full-time basis. When indirect and induced spending are included, the industry’s economic impact reaches $102 billion. There are an estimated 9.2 million horses in the U.S.

Consider this: In the five years to 2016, revenue for the Online Pet Food and Pet Supply Sales industry has increased at an annualized rate of 8.9% to total $4.9 billion. Rising pet ownership in the U.S. and growth across the e-commerce sector have caused the industry to experience overall growth, despite the recession, according to the IBISWorld's Online Pet Food and Pet Supply Sales Industry recent report on the sector.

Retail pet-related items range from dog treats to bird cages to cat carriers. Rising pet ownership and increased access to e-commerce websites have recently driven revenue growth for the industry. Analyst Anya Cohen notes that “rises in per capita disposable income and consumer spending have allowed shoppers to splurge on price-premium goods for their furry friends, which has driven revenue growth.”

Over the five years to 2016, positive trends have caused industry revenue to expand at an annualized rate of 8.9%, totaling $4.9 billion. This includes growth of 7.0% in 2016, driven primarily by a 10.7% increase in the number of broadband connections, which increases consumer access to the online-based retailers that operate in this industry.

While many factors have contributed to industry growth over the five years to 2016, one of the strongest drivers has been the increased acceptance of pets as full-fledged members of the family. Consumers who adopt this mentality are likely to splurge on price-premium goods and supplies, such as organic dry and wet food and designer-brand collars. As demand for these premium goods has increased, so too have industry profit margins. In 2016, IBISWorld estimates that industry profit will account for 4.4% of industry revenue, an increase from 2011 when margins stood at 3.7%.

Forecasts predict industry revenue will continue to rise. Throughout a five-year period, stores will benefit from an increasing number of pets in the U.S. and rising per capita disposable income. These drivers will increase overall sales volume, as well as the average cost per sale as cash-rich customers continue to splurge on price-premium goods.

However, online pet retailers will experience increasing competition from the brick-and-mortar stores that sell pet food and supplies, including grocery stores and big-box retailers. According to Cohen, “such stores are able to offer additional services, such as grooming and training, and use these value-added offerings to siphon consumer demand from the online-based companies that operate in this industry.”

Scott Mahoney is on Twitter @mahoneyteamms; or call (973) 425-8547. The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The views expressed herein are those of the author.